Get Ready For Grenada Citizenship By Investment

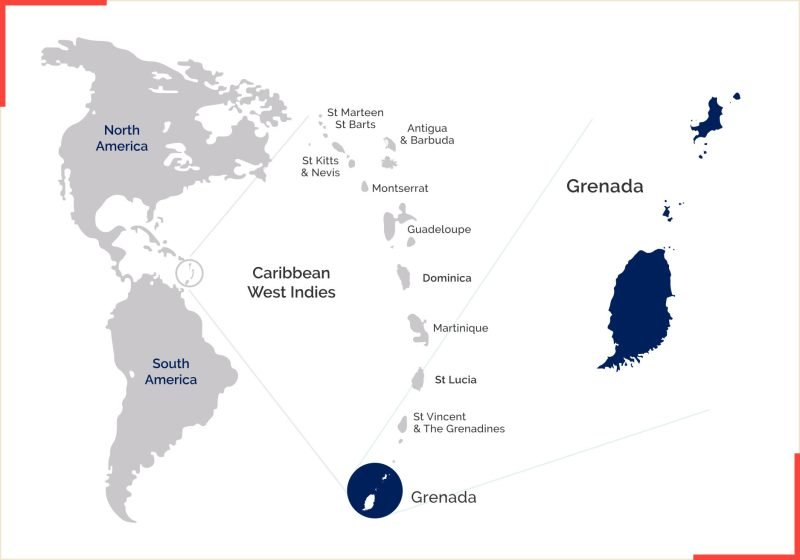

Welcome to the captivating island of Grenada, a Caribbean haven known for its breathtaking landscapes, vibrant culture, and prosperous economy. As one of the most beautiful destinations in the West Indies, the Grenada Citizenship by Investment program entices investors seeking an exceptional quality of life, lucrative business prospects, and a secure community.

Established in 2013, the Grenada Citizenship by Investment program (CBI) has quickly garnered global interest, becoming a popular destination for individuals searching for new horizons, boundless freedom, and a welcoming atmosphere. A Grenada passport grants its holders significant worldwide mobility, along with access to the nation’s thriving economy and favorable tax system.

With a flourishing tourism industry, promising agribusiness sector, and robust citizenship by investment program, Grenada is the ideal location to cultivate a prosperous future for yourself and your family.

About The Island

Grenada, also known as the “Island of Spice,” is a bewitching Caribbean nation that offers stunning scenery, a rich history, and an enticing investment environment. The island also appeals to eco-conscious investors and residents with its commitment to sustainability and environmental conservation, making it a model for green initiatives in the Caribbean.

CAPITAL

Saint George’s

POPULATION

124,610

TOTAL AREA

348.5 km²

CURRENCY

East Caribbean Dollar

Geographical Location and Climate

Situated at the southern end of the Grenadines in the southeastern Caribbean Sea, Grenada consists of three main islands: Grenada, Carriacou, and Petit Martinique. The trio boasts diverse topography, including volcanic peaks, lush rainforests, pristine beaches, and picturesque harbors. The island enjoys a tropical climate, with temperatures ranging from 75°F (24°C) to 85°F (29°C) year-round. Grenada experiences two primary seasons: the wet season from June to November (which aligns with the Atlantic hurricane season) and the dry season from December to May.

Language and Culture

Grenada’s unique cultural heritage mirrors its multifaceted history. While English is the official language, residents commonly speak Grenadian Creole, which originated from French Patois and African dialects. The island’s diverse culture emerges in its vivid music, dance, cuisine, and folklore. Grenada’s lively Carnival celebration, known as “Spicemas,” annually attracts thousands of visitors who revel in vibrant costumes, traditional steel pan bands, and unforgettable calypso music.

Economic Overview

Tourism, agriculture, and the citizenship by investment program primarily drive Grenada’s economy. Grenada’s enchanting landscapes offer a haven for eco-tourism activities such as hiking, bird watching, and scuba diving, drawing visitors eager to experience its pristine natural beauty and commitment to environmental sustainability. The island’s economy is robustly supported by agriculture, with a focus on the cultivation of essential spices like nutmeg and mace, alongside cocoa, which is pivotal to its cultural and economic identity.

Why Choose The Grenada Citizenship By Investment Program?

FAMILY SAFETY AND FUTURE SECURITY

Your spouse, dependent children, parents and siblings can apply for their Grenadian citizenship along with you, with the option to relocate and work in any other Caribbean Community (CARICOM). Your children will also benefit from a 90% reduction in tuition fees to Saint George’s University, a world-renowned university for medical programs.

HEALTHCARE

Healthcare in Grenada is accessible to all citizens and is primarily funded by the government, ensuring that primary care services are provided free at the point of delivery. Grenada is known for maintaining one of the best healthcare systems in the Caribbean.

USA E-2 VISA

As a Grenadian passport holder, you are eligible to apply for the U.S. E-2 non-immigrant visa that allows you and your family to live and work in the USA.

VISA-FREE TRAVEL

As a citizen of Grenada, you will have visa-free access to over 148 countries, including the UK, all Schengen States, China, Russia, Singapore, and Hong Kong.

How to Qualify for the Grenada Citizenship by Investment Program

To qualify for the Grenada Citizenship By Investment program, applicants must meet the following criteria:

- Be in good health (and provide a medical certificate that proves this).

- Be 18 years or older.

- Have a clean personal and professional background with no criminal records (must not have been convicted of a crime in any country of which the maximum penalty exceeds 6 months imprisonment). A police certificate is required to prove this.

- Must not be the subject of a current criminal investigation.

- Must not have been refused a visa from a country that Grenada enjoys visa-free relations with and not later secured a visa from that refusing country.

- Provide evidence of legally acquired funds for the investment.

Eligible Family Dependents:

Family members who are financially dependent on the main applicant are eligible to include on the application. This includes a spouse, children, parents, grandparents and siblings.

Who is the Grenadian Citizenship by Investment Program Suitable For?

- Those looking for greater global mobility. As a citizen of Grenada, you will have visa-free access to over 148 countries.

- Those looking to diversify their assets and enjoy tax breaks. Grenada has no tax on worldwide income, capital gains, income, wealth, or inheritance.

- Anyone looking to live in a warm tropical climate part-year or all year round.

- Families looking to relocate as a family.

- Investors who don’t want to reside in Grenada, but want to invest.

Grenada Citizenship By Investment (CBI) Investment Options

The Grenada CBI offers potential foreign investors with two primary routes to obtain citizenship.

1. Grenada’s National Transformation Fund (NTF)

The first investment option involves financial contribution through a direct, non-refundable donation to the government fund the National Transformation Fund (NTF). This fund supports the development of various sectors, including infrastructure, healthcare, and education.

The minimum investment required is USD 235,000, which covers either a single applicant, a single applicant with a spouse, or a family of four—excluding parents, siblings, or grandparents under the age of 55. Any additional dependents beyond this will require an additional investment of USD 25,000 for each parent or grandparent over 55 or each child, USD 50,000 for each parent or grandparent under the age of 55, and USD 75,000 for each sibling.

Additional Fees (NTF Option)

| Main Applicant | Main Applicant & Spouse | Family of 4 Family Members | Family Over 4 members | |

|---|---|---|---|---|

| Application Fee | USD 1,500 | USD 1,500 per person | USD 1,500 per person | USD 1,500 per person |

| Due Diligence Fee | USD 5,000 | USD 5,000 per person | *USD 5,000 for a dependent 17 and over (Nil for dependent child 0-16) | *USD 5,000 for a dependent 17 and over (Nil for dependent child 0-16) |

| Processing Fee | USD 1,500 | USD 1,500 per person | USD 1,500 per person aged 17 and over, USD 500 for persons under 17 | USD 1,500 per person aged 17 and over, USD 500 for persons under 17 |

2. Government-Approved Real Estate Investment

The second investment route entails making a government-approved real estate investment. Investors must make a minimum investment of USD 220,000 into shares of real estate projects, such as hotels, villas, or resorts. Alternatively, the investor can be the sole purchaser of a property worth at least USD 350,000 and hold the property for at least five years. Only the primary applicant and successful applicants are responsible for government fees, due diligence fees, and processing fees.

Additional Fees (Real Estate Option)

| Main Applicant | Main Applicant & Spouse | Family of 4 Family Members | Family Over 4 members | |

|---|---|---|---|---|

| Government Fee | USD 50,000 | USD 50,000 | USD 50,000 | USD 25,000 for a dependent aged 17 and below, USD 50,000 for a dependent aged 18 and over, and USD 75,000 for a sibling |

| Application Fee | USD 10,000 | |||

| Due Diligence Fee | USD 7500 | USD 5000 per person | USD 5,000 for a dependent child 17 and over (nil for 0-16) | USD 5,000 for a dependent child 17 and over (nil for 0-16) |

| Processing Fee | USD 1500 | USD 1500 per person | *USD 1,500 per person aged 17 and over *USD 500 for persons under 17 | *USD 1,500 per person aged 17 and over *USD 500 for persons under 17 |

Application Process: Step-by-Step

Register TITOS GLOBAL as your Authorized International Marketing Agent

Titos Global is a trusted, government-approved facilitator of Citizenship by Investment programs. We will apply for your citizenship on your behalf, whilst coordinating with an Authorized Local Agent.

Gather Documents

Your next move is to work with us to gather documents together. We will guide you on completing forms, getting a medical check-up, and collecting all of the required documents. All documents must be in English. If you are buying a property, we will need to attach a sale and purchase agreement.

Submit Documents

Once your documents are ready, we will forward your application to the Citizenship by Investment Committee (CBIC) Executive Office. We will manage all further communications regarding your application.

Undergo Due Diligence Checks

The government reviews every application thoroughly, especially for background and information accuracy. The CBIC then suggests whether to approve or decline the application. The final decision rests with the Minister, who usually follows the CBIC’s advice.

Make Your Investment

If you receive a letter of approval, you must now make the required contribution or finalize your property purchase.

Receive Your Passport

Once the payment is confirmed, the CBIC gives you a registration certificate proving your Grenadian Citizenship. With this certificate, we will apply for your Grenadian passport/s on your behalf.

The total time between submitting your application and receiving your Grenadian passport will be around 3-4 months, however, the processing time will vary with each application.

Benefits of Grenada Citizenship By Investment

Family Inclusion

Grenada’s Citizenship by Investment Program allows the main applicant to include not only their spouse and dependent children but also dependent parents and grandparents, without requiring them to live in Grenada. This makes it possible for entire families to obtain citizenship simultaneously, fostering family unity and collective access to the benefits of Grenadian citizenship.

Affordable Investment with Legacy Benefits

Investing in the Grenada citizenship program is cost-effective, with options starting at USD 220,000. This investment not only secures citizenship but also ensures that it can be passed down to future generations, providing long-term security and benefits across generations.

Tax Advantages

Grenada offers a favorable tax regime for its citizens, including no foreign income tax, wealth tax, gift tax, or inheritance tax for non-residents. This can be particularly advantageous for investors looking to manage their global tax liabilities more efficiently.

Global Mobility

Grenada’s passport provides extensive travel freedom, granting visa-free or visa-on-arrival access to over 148 countries, including prominent business and travel destinations like the EU, the UK, and China. This makes it an excellent choice for business people and frequent travelers.

USA E-2 Visa Treaty

Grenada is unique amongst Caribbean countries with its access to the USA E-2 Visa scheme, which allows citizens to operate a business and reside in the U.S., presenting a valuable opportunity for entrepreneurs targeting the American market.

No Residency Requirement

Investors are not required to live in Grenada before or after obtaining citizenship, offering significant flexibility for those who wish to maintain their current living arrangements or business activities.

Dual Citizenship

Grenada recognizes dual citizenship, allowing individuals to retain their original nationality. This flexibility is beneficial for those from countries that also allow dual nationality and can offer potential tax advantages.

High Quality of Life

Grenada offers a high standard of living, known for its vibrant culture, warm climate, and beautiful landscapes. The healthcare system in Grenada predominantly offers free services, ensuring that primary care is accessible without direct charges. Grenada provides free schooling from pre-school through to secondary level, making education accessible to all. For higher education, St. George’s University is a key institution, internationally recognized, particularly for its medical and veterinary programs.

Additional Privileges

Grenadian citizens enjoy simplified eligibility with no language or academic requirements, eligibility for international sporting events like the Commonwealth Games, and protection by the embassies of other member states worldwide. Moreover, every citizen has a guaranteed right to a passport, ensuring they won’t be refused a passport or its renewal.

Taxes in Grenada

Taxes in Grenada play a crucial role in the country’s economic framework, attracting foreign investment with its favorable tax policies. The Grenadian tax system is structured to encourage investment, especially in the tourism and agricultural sectors, while providing a straightforward tax environment for residents and businesses.

Individual Tax

In Grenada, individuals are taxed based on their residence status. Residents are taxed on their worldwide income, whereas non-residents are taxed only on their Grenadian-sourced income.

Income Tax Rates: Grenada has a progressive income tax structure for individuals:

- Income up to XCD 24,000: 10%

- Above XCD 24,000: 30%

Residents are required to file an annual tax return with the Inland Revenue Department of Grenada.

Value Added Tax (VAT)

The standard VAT rate in Grenada is 15%. A reduced rate of 10% applies to the hospitality services, including hotels and accommodations. Essential goods such as basic food items, medicine, and educational services are exempt from VAT.

Property Tax

Property tax in Grenada is calculated based on the property’s market value:

- Residential properties: 0.2%

- Commercial properties: 0.3%

- Agricultural land (if operational): 0.05%

Additionally, citizens benefit from reduced property transfer tax rates compared to foreigners when selling real estate, with the rate typically set at around 5%.

Corporate Tax

The corporate tax rate in Grenada stands at a flat rate of 30%. Grenada offers various tax incentives for businesses, particularly in sectors such as tourism, agriculture, and manufacturing, which can significantly lower the effective tax rate.

Inheritance and Gift Tax

There are no inheritance or gift taxes in Grenada, making it an attractive location for wealth preservation and estate planning.

Social Security Contributions

Both employers and employees in Grenada are obligated to make social security contributions:

- Employees contribute 4% of their gross salary.

- Employers contribute 5%.

These contributions fund benefits such as pensions, sickness, and maternity leave.

Double Taxation Agreements

Grenada has established double taxation agreements (DTAs) with the United Kingdom and member countries of the Caribbean Community (CARICOM). These treaties are designed to prevent the double taxation of income earned in one jurisdiction from being taxed again in another, which helps to enhance cross-border trade and investment by reducing the tax burden on individuals and companies operating across these countries.

Withholding Tax

In addition to these grants for granted citizenship holders, there’s a withholding tax of 15% applied on non-residents receiving payment for various services such as interest (excluding bank deposits), other rental income, incomes, lease premiums, etc. This measure ensures that income earned within Grenada by non-residents is appropriately taxed.

Additional Tax Incentives and Relief in Grenada

Grenada provides various incentives that enhance its attractiveness for business and investment:

- Manufacturing Sector Incentives: Reduced tax rates and customs duty exemptions for machinery and raw materials.

- Tourism Sector Incentives: Various concessions including duty-free imports on items that are necessary for tourism development.

- Agricultural Sector Support: Exemptions from taxes on agricultural machinery and inputs to encourage local farming.

Personal Income Tax in Dominica

Personal income tax rates in Dominica have retained an advantageously low level compared to many global tax schemes.

The tax rates on personal income are as follows:

XCD 0 to XCD 30,000 (USD 11,100)= 0%

XCD 30,001 to XCD 50,000 (USD 18,500)= 15%

XCD50,001 to XCD 80,000 (USD 29,600)= 25%

XCD 80,001 and above= 35%

The average income in Dominica is around XCD 18,000 in 2024, which falls far below the threshold for tax payments.

Dominican citizens enjoy various benefits, including zero capital gains, inheritance, payroll, or property tax. However, it is important to note that global income is taxable for Dominican residents, excluding income exempt under the Tax Act or income that can only be taxed in the jurisdiction where it is earned due to tax treaties.

Income Tax Obligations for Non-residents In Dominica

Non-residents are only taxed on income that is earned or derived from sources within Dominica. This includes income from employment, business activities, property, and investments located in the country. This income will be subject to a flat withholding tax rate of 15% on employment income earned in Dominica. However, business-related income is subject to the corporate tax rate of 25%.

Corporate Tax

Local corporations are subject to a 25% corporate tax rate, while international business companies (IBCs) generally do not pay corporate taxes on income earned outside Dominica. Additionally, Dominica has double taxation treaties with CARICOM countries to prevent the same income from being taxed twice. Non-residents are subject to a 15% withholding tax on earnings such as dividends, interest on deposits, rental income, and royalties.

Property and Other Taxes In Dominica

No taxes are levied on the capital gains from purchasing or selling property in Dominica, encouraging foreign investment. However, municipal taxes, stamp duty, and legal fees may apply during transactions or ownership. The income generated from property sales remains untaxed. Annual road taxes/license fees and registration fees apply for those planning to own vehicles or yachts. Additionally, various taxes impact different sectors of the economy, all designed to bolster Dominica’s socioeconomic environment while maintaining its appeal to overseas investors.

The associated costs with buying and selling property are as follows:

Transfer Tax (Seller)- 2.5%

Transfer Tax (Buyer)- 4%

Judicial Fee (Buyer)- 2.5%

Assurance Fee (Buyer)- 1%

Grenada Citizenship By Investment FAQs

How Much Does Citizenship by Investment Cost in Grenada?

The minimum investment required for the Grenada CBI Program is USD 220,000. Two investment options exist: a non-refundable donation to the NTF or making a government-approved real estate investment. For the NTF option, the minimum investment is USD 235,000, which covers a single applicant up to a family of four. The approved real estate projects option demands a minimum investment of USD 220,000 into real estate shares or the purchase a property worth USD 350,000, with a holding period of at least five years. To be updated on the investment price and other details, you may check the IMA’s website at https://imagrenada.gd/.

How Long Does the Grenada Citizenship Process Take?

Typically, the Grenada citizenship application process requires three to four months from the submission of the application to the issuance of a Grenadian passport. The actual timeline can vary based on individual cases and the thoroughness of the due diligence process.

How Much Money Do You Need to Retire in Grenada?

Your budget for retiring in Grenada will largely depend on your lifestyle preferences, healthcare needs, and choice of housing. Generally, the cost of living in Grenada is more affordable than in many Western countries. For a comfortable retirement that includes includes housing, utilities, groceries, healthcare, and leisure activities, a monthly budget of USD 2,000 to USD 3,000 is advisable. However, for those with more modest needs, USD 1,500 to USD 2,000 per month should be sufficient, depending on the specific location and personal spending habits.

How Much is Rent in Grenada?

In Grenada, rental costs present excellent value, particularly when compared to urban centers in the US or Europe. For example, renting a one-bedroom apartment outside city centers in Grenada typically costs around USD 370 per month. For those needing more space, a three-bedroom apartment situated away from central areas generally costs about USD 645 per month. These affordable rental prices make Grenada an attractive option for anyone looking to stretch their budget further while enjoying the island’s scenic charm.

Can You Have Dual Citizenship in Grenada?

Yes, you can have dual citizenship in Grenada. The country permits individuals to maintain their current nationality in addition to Grenadian nationality. A Grenadian passport, ranked 33rd by the Global Passport Index, offers visa-free travel for you and your family to over 148 countries worldwide.

Which Cities Fly Direct to Grenada?

There are direct flights to Grenada from major cities such as Miami, Atlanta, New York, Toronto, Frankfurt, and London.

How Long is a Grenadian Passport Valid For?

Your passport from Grenada will be valid for 5 years.

Where Can I Renew My Grenadian Passport?

You can renew your Grenadian passport either at the Grenadian Consulate in London or directly through the Grenadian Passport and Immigration Office.

How Do I Obtain Permanent Residency in Grenada?

Achieving permanent residency economic citizenship in Grenada can be accomplished through various methods such as long-term residence, family reunification, or investment. If you aren’t applying to acquire citizenship via the Citizenship by Investment Program, you must first reside in Grenada for five years and meet eligibility criteria like financial self-sufficiency and good character. After meeting these qualifications, permanent residency is attainable through appropriate channels, like the Grenada Immigration Department.