Welcome to Antigua And Barbuda Citizenship By Investment

Thanks to its tourism industry and offshore financial services, Antigua and Barbuda is one of the Caribbean’s most prosperous nations. The island is ringed by coral reefs, sandy beaches, national parks and other breathtaking natural attractions. All of which makes the Antigua and Barbuda citizenship by investment program extremely popular with global investors.

Since the launch of the Antigua and Barbuda Citizenship by Investment Program (CBI) back in 2013, the Caribbean country has fast become one of the most sought-after destinations for those chasing better opportunities, greater freedom and stability.

Not only do Antigua and Barbuda passport holders benefit from significant global mobility through visa free travel to a number of countries, but the country offers political and economic stability and an attractive tax regime.

About Antigua And Barbuda

Antigua and Barbuda is home to some of the Caribbean’s most beautiful beaches, including Half Moon Bay, Turner’s Beach and Darkwood Beach as well as stunning coral reefs, lush rainforests and a variety of activities such as sailing, diving and snorkeling. Its culture is incredibly diverse with influences from West Africa, India and Europe present in its art forms, religions, music and cuisine, making it an attractive destination for many visitors.

In recent years, the nation’s popularity has been further enhanced by its Citizenship by Investment Program (CIP), offering wealthy individuals citizenship in exchange for investing directly into the economy or through approved real estate projects on the islands.

CAPITAL

Saint John's

POPULATION

93,932

TOTAL AREA

440 km²

CURRENCY

East Caribbean Dollar

Geographical Location and Climate

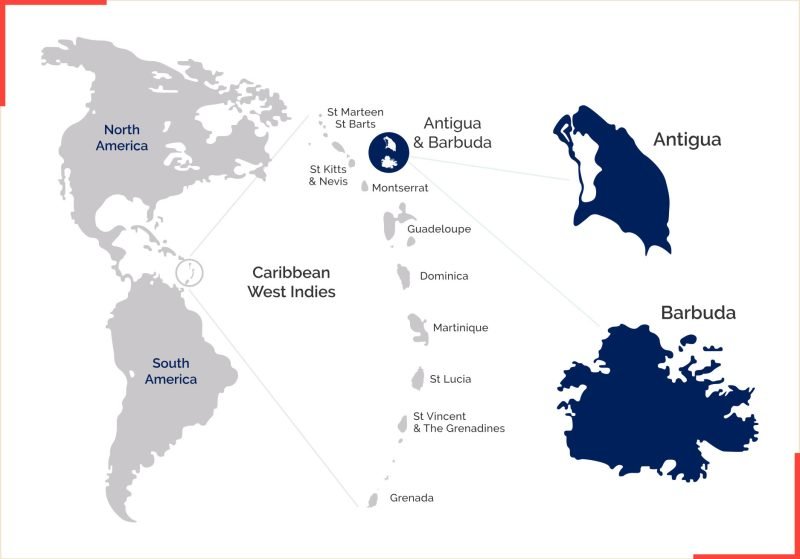

Antigua and Barbuda, part of the Leeward Islands in the Eastern Caribbean, consists of two main inhabited islands, Antigua and Barbuda, and several smaller islands. Covering an area of approximately 442 square kilometers, Antigua is the larger and more populous island, known for its 365 beaches, one for each day of the year. Barbuda, located about 63 kilometers north of Antigua, is renowned for its untouched beauty and significant bird sanctuaries.

The climate of Antigua and Barbuda is tropical maritime with little seasonal temperature variation. Temperatures typically range from 23°C (73°F) to 31°C (88°F) throughout the year. The islands experience a wet season from June to November, coinciding with the hurricane season, and a dry season from December to May. Despite this, their relatively low humidity and constant northeastern trade winds provide a comfortable climate year-round.

Language and Culture

The official language of Antigua and Barbuda is English, reflecting its history as a former British colony. However, many locals also speak Antiguan Creole, which is heavily influenced by English and African linguistic patterns. The culture of Antigua and Barbuda is a vibrant fusion of African, British, and indigenous influences, which is evident in its music, dance, and festivals.

The islands are particularly known for their annual Carnival; a celebration of emancipation featuring colorful costumes, parades, and music, particularly soca, and calypso. The culture is also expressed through cricket, a legacy of British colonial influence, which remains the most popular sport.

Economic Overview

Tourism is the backbone of Antigua and Barbuda’s economy, leveraging the islands’ reputation for luxury resorts, breathtaking beaches, and favorable sailing conditions. The government actively promotes yachting and sailing, which is highlighted by events such as Antigua Sailing Week and the Antigua Classic Yacht Regatta.

Besides tourism, the twin islands have developed a growing financial services sector and benefit from their Citizenship by Investment program. This program offers citizenship to those who make a significant economic contribution to the country, either through a donation to the National Development Fund or an investment in approved real estate projects. These contributions bolster the economy and fund public projects, including the development of infrastructure and renewable energy initiatives.

Why Choose Antigua And Barbuda Citizenship By Investment

VISA FREE TRAVEL

As a citizen of Antigua and Barbuda, you can gain visa free access when travelling to over 151 countries – including the UK and Schengen states, as well as major countries in North America, Latin America and Asia.

FAMILY SAFETY AND FUTURE SECURITY

The Antiguan and Barbudan citizenship can be extended to your spouse, dependent children and parents. Antigua is known for being a very secure and stable country, offering you and your family a high-quality life.

FAST APPLICATION PROCESS

Obtain your Antiguan and Barbudan passport with only 3-6 months, without the need to visit or reside on the islands. Antigua and Barbuda allows dual citizenships, which means that you do not have to renounce your original nationality.

BUSINESS BENEFITS

Antigua and Barbuda passport holders benefit from important tax advantages, such as no capital gains, estate or foreign income tax. The country also has a fixed USD currency and duty-free trading across the Caribbean.

How to Qualify for Antigua and Barbuda Citizenship by Investment

Antigua And Barbuda Citizenship By Investment Eligibility Requirements

To qualify for the Antigua & Barbuda citizenship program, applicants must meet certain requirements:

- The primary applicant must be at least 18 years old

- Have no criminal record

- Possess a valid passport from their country of residence (which should also allow them entry into Antigua and Barbuda)

- Provide proof of investment funds and demonstrate that their source of wealth is legitimate

- Obtain medical clearance certificates proving good health

- Prove that they do not pose any risk or threat to national security or public order within the twin-island nation

- Provide two reference letters from reputable sources who can vouch for their good character, plus pay all applicable fees associated with applying

- Applicants cannot apply if they are nationals from Afghanistan, Iran, North Korea, Somalia, Yemen, or Sudan. Exceptions apply if an individual left the restricted country before adulthood, lived in a non-restricted country for at least 10 years, and has no economic ties to any restricted countries.

Eligible Family Dependents

- A spouse of the main applicant

- A child of the main applicant or their spouse, aged between 0-30 years, who relies financially on the main applicant;

- A child of the main applicant or their spouse, aged 18 years or older, who has a physical or mental disability, lives with the main applicant, and is entirely supported by them;

- A parent or grandparent of the main applicant or their spouse, aged 55 years or older, who relies financially on the main applicant;

- An unmarried sibling of the main applicant or their spouse;

- A prospective spouse of the main applicant (a fee of USD 50,000 is required upon application);

- A prospective spouse of a dependent child, provided that the child is financially dependent on the main applicant

- A future child of a dependent child (a fee of USD 10,000 is applicable for children under 6 years, and USD 20,000 for children aged 6-17 years).

Antigua And Barbuda Citizenship By Investment (CBI) Investment Options

Acquiring citizenship by investment in Antigua and Barbuda provides qualified applicants with diverse financial pathways, each devised with lucrative returns. Included are four investment categories that applicants must choose from and fulfill.

1. National Development Fund (NDF)

This not-for-profit fund offers applicants the option to contribute a non-refundable amount of USD 230,000, which covers a single applicant up to a family of 5 or more.

The primary applicant can include their spouse, dependent children, and dependent parents aged 55 or older in the application without an additional National Development Fund (NDF) contribution. However, government and due diligence fees are still required for each individual, as detailed in the fees section.

The fund supports government-backed initiatives, inclusive of public-private partnerships and other approved investments, thus propelling national development.

Additional Fees (NDF Option)

| Main Applicant | A Family of 4 or Less | Children between 12-17 years of age | Children over 18 years of age | |

|---|---|---|---|---|

| Due Diligence Fee | USD 8500 | USD 5000 for spouse, USD 4000 for dependents over 18, USD 2000 for dependents aged 12-17 | USD 2000 | USD 4000 |

| Processing Fee | USD 10,000 (if applying alone) | USD 20,000 (includes main applicant) | USD 10,000 from the 5th dependent onwards) | USD 10,000 from the 5th dependent onwards) |

| Passport Fee | USD 300 | USD 300 per person | USD 300 | USD 300 |

| Mandatory Interview (per application) | USD 1,500 | USD 1,500 per person | USD 1500 (for applicants aged 16 and over) | USD 1500 |

2. The University of the West Indies Fund (UWI)

Pledging a non-recoupable contribution to UWI’s fourth campus is another investment alternative. Priced at USD 260,000, it caters to applications intended for a family of six or more members and provides one privileged family member with a one-year, tuition-only scholarship at UWI.

Additional Fees (UWI Option)

| Main Applicant | Spouse | Children between 12-17 years of age | Children over 18 years of age | |

|---|---|---|---|---|

| Due Diligence Fee | USD 8500 | USD 5000 | USD 2000 | USD 4000 |

| Processing Fee | Nil | Nil | Nil | USD 10,000 for each additional dependant over a family of 6 |

| Passport Fee | USD 300 | USD 300 | USD 300 | USD 300 |

| Mandatory Interview (per application) | USD 1,500 | USD 1500 | USD 1500 (for applicants aged 16 and over) | USD 1500 |

3. Real Estate Investment

This alternative allows applicants to acquire approved property, either independently, for a minimum of USD 300,000, or jointly, with an investment of no less than USD 200,000 each. However, the resale of the property is restricted until five years have passed following the purchase unless the property being acquired is an officially approved alternate real estate property.

Additional Fees (Real Estate Option)

| Main Applicant | A Family of 4 or Less | Children between 12-17 years of age | Children over 18 years of age | |

|---|---|---|---|---|

| Due Diligence Fee | USD 8500 | USD 5000 for spouse, USD 4000 for dependents over 18, USD 2000 for dependents aged 12-17 | USD 2000 | USD 4000 |

| Processing Fee | USD 10,000 (if applying alone) | USD 20,000 (includes the main applicant) | USD 10,000 from the 5th dependent onwards) | USD 10,000 from the 5th dependent onwards) |

| Passport Fee | USD 300 | USD 300 per person | USD 300 | USD 300 |

| Mandatory Interview (per application) | USD 1,500 | USD 1,500 | USD 1500 (for applicants aged 16 and over) | USD 1500 |

4. Business Investment

Finally, prospects can purchase an approved business for a minimum sum of USD 1.5 million personally or opt for a joint investment equating to at least USD 5 million, with each participant contributing a minimum of USD 400,000.

Additional Fees (Business Investment Option)

| Main Applicant | A Family of 4 or Less | Children between 12-17 years of age | Children over 18 years of age | |

|---|---|---|---|---|

| Due Diligence Fee | USD 8500 | USD 5000 for spouse, USD 4000 for dependents over 18, USD 2000 for dependents aged 12-17 | USD 2000 | USD 4000 |

| Processing Fee | USD 10,000 (if applying alone) | USD 20,000 (includes the main applicant) | USD 10,000 from the 5th dependent onwards) | USD 10,000 from the 5th dependent onwards) |

| Passport Fee | USD 300 | USD 300 per person | USD 300 | USD 300 |

| Mandatory Interview (per application) | USD 1,500 | USD 1,500 | USD 1500 (for applicants aged 16 and over) | USD 1500 |

Antigua And Barbuda Citizenship Application Process And Timeline

Partner With Tito’s Global

Start your application process by partnering with Next Generation Equity. We will act as your authorised agent throughout the Citizenship by Investment process. We will guide you through every step and ensure you comply with Antigua and Barbuda’s regulations. We will perform a preliminary due diligence check to detect any potential issues that might arise later.

Choose Your Investment Option

Choose from approved investment options, including the National Development Fund (NDF) Donation, Real Estate Investment, Business Investment, or the University of the West Indies Fund (UWIF).

Prepare Documents (2 to 4 weeks)

Legal advisors from Next Generation Equity will assist you in preparing, translating, and notarizing all of your necessary personal and financial documents.

Submit Application

We will submit your complete application along with due diligence fees, 10% of the government processing fee, and the required documents such as birth certificates, marriage certificates, and proof of funds.

Undergo Due Diligence (3 months minimum)

The Citizenship by Investment Unit (CIU) of Antigua and Barbuda conducts thorough checks against international databases to validate the applicant’s information, as well as any dependents.

Attend Mandatory Online Interview

As part of the due diligence process, all individuals aged 16 and over must attend a virtual interview with the Citizenship by Investment Unit (CIU) as part of the evaluation process.

Receive Approval and Make Your Investment (30 days)

Once you receive your Approval In Principle letter, fulfil your chosen investment within 30 days to proceed with the citizenship issuance.

Receive Citizenship and Passport (4 weeks)

After investment verification, the CIU issues a Certificate of Registration. Then, we will apply for an Antiguan passport on your behalf, which is typically issued within four weeks of the investment. The documents can be couriered to an address of your choice.

Take an Oath of Allegiance (1 day)

Finalize the citizenship process by taking the Oath of Allegiance (along with all adult family members), which can be completed via video conference, in person within Antigua and Barbuda or at an Embassy, High Commission, or Consular Office of Antigua and Barbuda.

Maintaining Citizenship (Annual check)

As part of the program’s uniqueness, successful applicants are obligated to reside in Antigua and Barbuda for a minimum of five days during the first five years of obtaining their citizenship. While this may vary with certain options like the real estate investment, it still remains a requirement in the process.

Tax Advantages of Antigua and Barbuda Citizenship

- Investing in Antigua and Barbuda not only rewards you with a coveted passport with visa-free access to more than 151 destinations worldwide but also presents one of the most generous tax regimes worldwide. If you gain Antiguan and Barbudan citizenship through investment, you acquire the right to become a tax resident of the country, which consists of many tax benefits.

No Personal Income Tax

Antigua and Barbuda has no personal income tax. Personal income tax was abolished in 2016, positioning the nation competitively in the Caribbean region aiming to lure foreign investors and high-net-worth individuals. Keep in mind that if you don’t spend at least 183 days in Antigua and Barbuda a year, you will not be a registered tax resident and you will be subject to a 25% withholding tax on any income sourced in Antigua and Barbuda.

Favorable Corporate Tax Structure

For businesses, the corporate tax rate stands at 25%, applicable to resident companies on worldwide income. Non-resident companies are taxed only on income sourced from Antigua and Barbuda. However, foreign tax relief does exist under certain conditions such as having paid taxes in a fellow British commonwealth country or one where there is a tax treaty.

Property Tax

Also referred to as real estate tax, property tax in Antigua and Barbuda is based on the assessed value of the property:

- Rates: Property tax rates range from 0.1% to 0.5% of the property’s assessed value. This tax is payable annually and is an ongoing cost of property ownership in the country. The same rates apply to both residents and non-residents, ensuring equality for local and foreign investors.

- Exemptions: Certain properties, such as those used for tourism or government-approved projects, may qualify for reduced rates or exemptions.

Stamp Duty

Stamp duty is a crucial component of real estate transactions and is split between the buyer and the seller:

Rate: The total stamp duty is 10% of the property’s taxable value, divided as follows:

- Seller: Pays 7.5% of the taxable value.

- Buyer: Pays 2.5% of the taxable value.

Exemptions: Some exemptions or reductions may apply for certain types of transactions, such as transfers within families or government-endorsed projects.

Establishing Tax Residency

To establish tax residency in Antigua and Barbuda, you must maintain a residential address in the country, spend a minimum of 30 days per year in Antigua and Barbuda, and have a substantial annual income. You will be required to pay a flat tax of USD 20K per annum. Once you pay this flat fee and become a tax resident, you can enjoy several benefits such as no taxes on worldwide income, personal income, capital gains, inheritance, and wealth.

Double Tax Agreements

Antigua and Barbuda has established double taxation agreements (DTAs) with several countries to promote cross-border investment and eliminate the risk of being taxed twice on the same income. These agreements ensure that income earned in Antigua and Barbuda by residents of treaty countries, or vice versa, is only taxed in one jurisdiction or receives reduced tax rates. Countries with which Antigua and Barbuda has DTAs include the United Kingdom, Canada, and CARICOM (Caribbean Community) member states. The treaties cover various types of income, such as dividends, royalties, and interest, providing significant benefits for businesses and individuals engaged in international activities.

Dual Citizenship With Antigua And Barbuda

Antigua and Barbuda permits the holding of dual citizenship. This is explicitly assured in the country’s constitution, which was established in 1981. Hence, individuals can retain their original nationality while gaining Antiguan and Barbudan nationality as well. This provides the freedom and flexibility to maintain connections to both countries, allowing for the wide-ranging benefits of dual nationality.

However, it’s important to note that the acceptance of dual citizenship is contingent upon the regulations of your country of origin. Some nations may not permit dual citizenship, requiring their nationals to relinquish their original citizenship upon acquisition of a new one. As such, it’s essential to consult with the specific citizenship laws of your home country to determine whether you’ll be able to sustain your original citizenship while also becoming a national of Antigua and Barbuda.

Antigua and Barbuda Citizenship By Investment FAQs

How Do I Become a Citizen of Antigua and Barbuda?

To become a citizen of Antigua and Barbuda through their Citizenship by Investment Program, you must either make a non-refundable contribution of USD 230,000 to the National Development Fund or USD 260,000 to the University of West Indies Fund, purchase government-approved property valued at least USD 400,000 or invest USD 1.5 million in a government-approved business.

Can the Investment Be Financed Through a Loan?

No, the investment must be made with funds that belong to you and not financed through a loan or a similar arrangement, ensuring that the funds are free from liens or encumbrances.

Is Antigua and Barbuda a Good Place to Invest?

Yes, Antigua and Barbuda is considered a good place to invest. The nation’s stable political climate and growing economy, driven by tourism and real estate, create favorable conditions for investment. The government’s efforts to attract foreign direct investment through incentives and the development of critical infrastructure further enhance its appeal. Real estate investment, especially in tourism-related properties, is particularly promising given the islands’ beautiful landscapes and increasing popularity as a tourist destination.

How Long Does it Take to Get Antigua and Barbuda Citizenship?

The entire process, from application submission to receiving your passport, usually takes 3-6 months, depending on the length of the due diligence process and the completeness of the application submission. The processing time could be extended if discrepancies are found during background checks or if there are other unforeseen issues with the documentation submitted.

Which Family Members Can I Include in My Antigua and Barbuda Citizenship Application?

You can include your spouse, dependent children under 31, dependent parents or grandparents over 55, and siblings under 26 (if unmarried and without children) in your application.

Are There Countries That Are Restricted From Applying to Antigua and Barbuda’s Citizenship by Investment Program?

Yes, the countries that face restrictions from Antigua and Barbuda’s citizenship by investment include Afghanistan, Iran, North Korea, Somalia, Yemen, and Sudan. Nationals from these countries face additional criteria to qualify for citizenship under the Citizenship by Investment Program.

Can Nationals From Restricted Countries Apply for Citizenship in Antigua and Barbuda?

Yes, nationals from the restricted countries can apply for citizenship if they meet specific conditions. Eligible individuals must have migrated from the restricted country before reaching the age of majority and have maintained permanent residence in a non-restricted country for at least 10 years. They must also have no economic ties to any of the restricted countries.

What is the Cheapest Caribbean Citizenship By Investment?

Antigua & Barbuda offers one of the cheapest Caribbean citizenship by investment programs, with the lowest investment amount costing only USD 230,000, covering a family of up to four people.